Sure! Here’s a comprehensive article titled “Protecting What Matters: Understanding Your Insurance Needs.”

Protecting What Matters: Understanding Your Insurance Needs

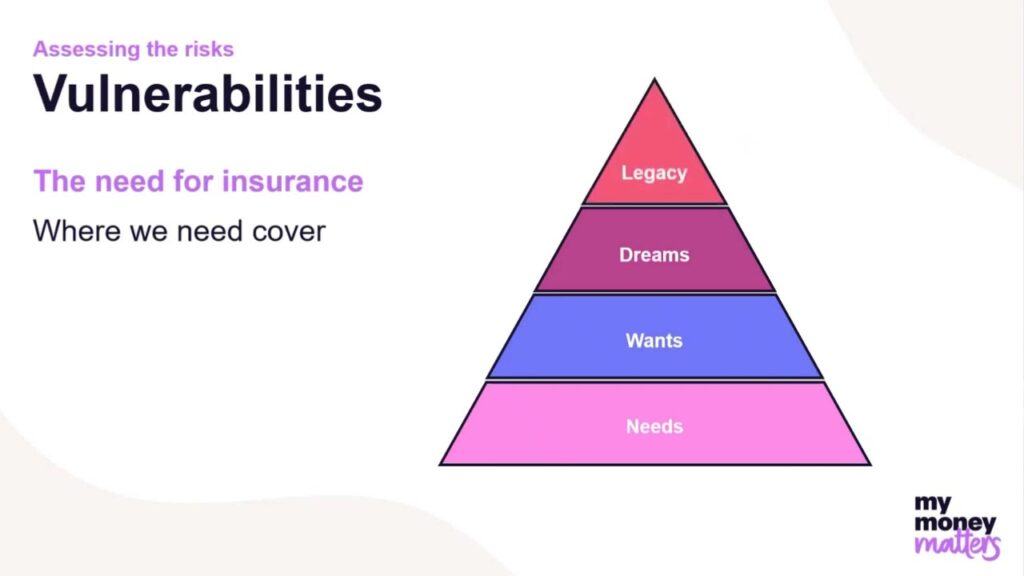

In an increasingly uncertain world, insurance serves as a critical safety net, offering financial protection against unforeseen events. Whether it’s safeguarding your health, your home, or your vehicle, understanding your insurance needs is essential for making informed decisions. This article will guide you through the different types of insurance available, the factors to consider when choosing coverage, and tips for finding the best policies for your situation.

The Importance of Insurance

Insurance is designed to mitigate risks and provide peace of mind. It serves as a contract between you and the insurance provider, where you pay a premium in exchange for coverage against specified risks. This protection can be invaluable in times of crisis, helping you recover financially without incurring overwhelming debt.

Key Benefits of Insurance:

- Financial Security: Insurance helps to protect your assets and investments from unexpected events. This financial cushion can be critical in times of loss or disaster.

- Peace of Mind: Knowing that you have insurance coverage allows you to focus on other aspects of life, reducing anxiety about potential risks.

- Legal Requirement: Some types of insurance, such as auto insurance, are legally mandated in many jurisdictions, making it essential for compliance.

Types of Insurance

Understanding the various types of insurance available can help you identify what coverage is most relevant to your needs:

- Health Insurance: This is perhaps one of the most crucial types of insurance, providing coverage for medical expenses. With rising healthcare costs, having a health insurance plan can significantly ease the financial burden of medical emergencies, routine check-ups, and prescription medications.

- Auto Insurance: If you own a vehicle, auto insurance is not only a legal requirement in most places, but it also protects you financially in the event of an accident, theft, or damage to your vehicle. Policies typically cover liability, collision, and comprehensive coverage.

- Homeowners or Renters Insurance: Homeowners insurance protects your home and personal belongings from risks such as fire, theft, and natural disasters. Renters insurance offers similar protection for tenants, covering personal property and liability.

- Life Insurance: This type of insurance provides financial support to your beneficiaries in the event of your passing. It can help cover funeral costs, debts, and provide ongoing support for your family.

- Disability Insurance: Disability insurance offers income protection in the event that you cannot work due to a disability. This coverage is vital for maintaining your financial stability during recovery periods.

- Liability Insurance: This type of insurance protects you from legal claims against you. It can cover personal injury, property damage, and legal expenses, making it essential for business owners and those in professions with a higher risk of liability.

Assessing Your Insurance Needs

Determining your insurance needs involves evaluating your lifestyle, assets, and potential risks. Here are some factors to consider:

- Life Stage: Your insurance needs will vary based on your life stage. For instance, a young single professional may prioritize health and renters insurance, while a family may need additional coverage like life and homeowners insurance.

- Assets: Consider what you own that needs protection. This includes your home, vehicles, savings, and any valuable possessions. The more assets you have, the more comprehensive your coverage should be.

- Health Considerations: If you have pre-existing medical conditions or a family history of certain illnesses, investing in a robust health insurance policy is crucial to ensure you have access to necessary medical care without financial strain.

- Occupation and Lifestyle: Certain jobs and activities carry higher risks. For example, if you work in a hazardous environment or participate in extreme sports, you may require specialized insurance coverage.

- Financial Obligations: Consider your debts and financial responsibilities. If you have significant loans or dependents relying on your income, life insurance and disability insurance may be particularly important.

Finding the Right Insurance Policy

Once you’ve assessed your insurance needs, the next step is to find the right policy. Here are some tips to help you navigate this process:

- Shop Around: Don’t settle for the first quote you receive. Obtain quotes from multiple insurance providers to compare coverage options, premiums, and deductibles.

- Understand Policy Terms: Read the fine print of any policy carefully. Make sure you understand what is covered, what is excluded, and any terms or conditions that may affect your coverage.

- Consider Bundling Policies: Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. This can lead to significant savings while ensuring comprehensive coverage.

- Review Financial Strength: Research the financial stability of the insurance company. Look for ratings from agencies like A.M. Best, Moody’s, or Standard & Poor’s to ensure the company can fulfill its obligations.

- Consult an Insurance Agent: If you’re unsure about what coverage you need, consider consulting with a licensed insurance agent. They can provide personalized advice based on your unique situation.

Regularly Reviewing Your Insurance

Your insurance needs may change over time due to life events such as marriage, having children, or purchasing a new home. It’s essential to review your insurance policies regularly to ensure they still align with your current situation.

Consider scheduling an annual review to evaluate your coverage and make adjustments as necessary. This proactive approach can help you avoid gaps in coverage and ensure you’re not overpaying for insurance you no longer need.

Conclusion

Insurance is a vital tool for protecting what matters most in your life. By understanding the different types of insurance available and assessing your individual needs, you can make informed decisions that provide financial security and peace of mind. Whether you’re just starting to explore your insurance options or are looking to reevaluate your current coverage, taking the time to understand your insurance needs is an investment in your future security.

This article provides an overview of insurance needs and can serve as a helpful resource for individuals looking to understand their options better. If you need any specific adjustments or additional information, just let me know!