Insurance Demystified: Key Insights for Smart Decision-Making

Insurance is often seen as a complex and daunting subject, filled with jargon, complicated terms, and endless options. However, understanding the fundamentals of insurance is essential for making informed decisions that can protect your finances, assets, and well-being. This article aims to demystify insurance by breaking down its key components, types, and strategies for smart decision-making.

What is Insurance?

At its core, insurance is a financial product that provides protection against potential future losses. When you purchase insurance, you enter into a contract with an insurance company, which agrees to compensate you for specific losses in exchange for regular premium payments. This system spreads the risk among a larger pool of policyholders, allowing individuals and businesses to manage potential financial burdens more effectively.

The Importance of Insurance

Insurance plays a crucial role in providing financial security and peace of mind. Here are some reasons why insurance is important:

- Protection Against Financial Loss: Insurance helps mitigate the financial impact of unexpected events, such as accidents, illnesses, natural disasters, or theft. It provides a safety net that can cover medical expenses, property damage, and legal fees.

- Legal Requirements: Certain types of insurance are legally required. For instance, auto insurance is mandatory in most states, and many lenders require homeowners to have insurance as a condition for a mortgage.

- Business Continuity: For businesses, insurance is essential for continuity. It protects against various risks that can disrupt operations, such as liability claims, property damage, and employee injuries.

- Peace of Mind: Knowing you have insurance coverage can relieve stress and anxiety, allowing you to focus on other aspects of life without constantly worrying about potential disasters.

Types of Insurance

There are many types of insurance, each designed to cover specific risks. Here are some of the most common types:

1. Health Insurance

Health insurance covers medical expenses incurred due to illnesses, injuries, or preventive care. It typically includes coverage for doctor visits, hospital stays, prescription medications, and preventive services. Understanding the different types of health insurance plans—such as HMOs, PPOs, and high-deductible plans—is essential for choosing the right coverage for your needs.

2. Auto Insurance

Auto insurance provides financial protection in the event of an accident or theft involving your vehicle. Policies typically cover liability (injuries or damages to others), collision (damage to your vehicle), and comprehensive coverage (non-collision incidents like theft or natural disasters). It’s important to understand your state’s minimum coverage requirements and the various options available to tailor your policy.

3. Homeowners and Renters Insurance

Homeowners insurance protects your home and belongings from risks such as fire, theft, or natural disasters. It also provides liability coverage in case someone is injured on your property. Renters insurance offers similar protection for tenants, covering personal belongings and liability without covering the building itself.

4. Life Insurance

Life insurance provides financial support to your beneficiaries in the event of your death. There are two primary types: term life insurance, which covers you for a specified term, and whole life insurance, which provides lifelong coverage and includes a savings component. Assessing your family’s financial needs is crucial when deciding on the right policy.

5. Disability Insurance

Disability insurance protects your income if you become unable to work due to a disability. Short-term disability insurance typically covers a portion of your salary for a limited time, while long-term disability insurance provides coverage for an extended period. Understanding your employer’s offerings and your personal needs is essential for adequate protection.

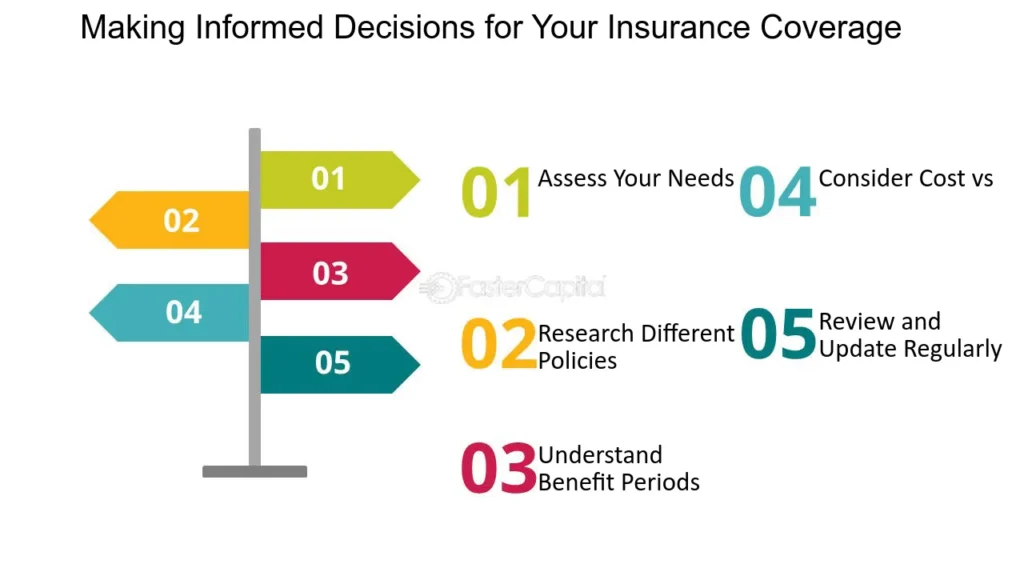

Key Insights for Smart Decision-Making

Making informed decisions about insurance can save you money and ensure you have the right coverage. Here are some key insights to guide your choices:

1. Assess Your Needs

Before purchasing insurance, assess your individual needs and risks. Consider factors such as your health, lifestyle, family situation, and financial obligations. For example, a young, single individual may require different coverage than a family with children and a mortgage.

2. Shop Around

Insurance premiums can vary significantly among providers, so it’s crucial to shop around and compare quotes. Use online tools and resources to gather information on different policies and coverage options. Don’t hesitate to ask for recommendations or consult with an insurance agent for expert advice.

3. Understand Policy Details

Insurance policies often contain complex terms and conditions. Take the time to read the fine print, and make sure you understand the coverage limits, exclusions, deductibles, and any additional riders or endorsements. Don’t hesitate to ask your insurer for clarification on any confusing terms.

4. Bundle Policies for Savings

Many insurance companies offer discounts for bundling multiple policies, such as auto and homeowners insurance. This not only saves you money but also simplifies managing your coverage. Ask your insurer about available bundling options and potential savings.

5. Review and Update Regularly

Your insurance needs may change over time due to life events such as marriage, having children, or purchasing a home. Regularly review your policies and make necessary updates to ensure you have adequate coverage. Annual reviews can help you identify any gaps in coverage or opportunities for savings.

6. Consider the Insurer’s Reputation

When choosing an insurance provider, consider their reputation and financial stability. Research customer reviews, ratings from independent agencies (like A.M. Best or J.D. Power), and the insurer’s claims process. A reputable insurer will provide reliable service and support when you need it most.

7. Seek Professional Advice

If you find insurance overwhelming, consider seeking advice from a licensed insurance agent or broker. They can help you navigate the complexities of different policies, provide personalized recommendations, and ensure you’re making informed decisions based on your unique circumstances.

Conclusion

Insurance is a vital component of financial planning that provides protection and peace of mind against life’s uncertainties. By understanding the different types of insurance, assessing your needs, and making informed decisions, you can ensure that you have the right coverage to protect your assets and loved ones. Remember that insurance is not a one-size-fits-all solution; take the time to evaluate your options and choose policies that best fit your situation. With the right knowledge and resources, you can demystify insurance and make smart choices that enhance your financial security.