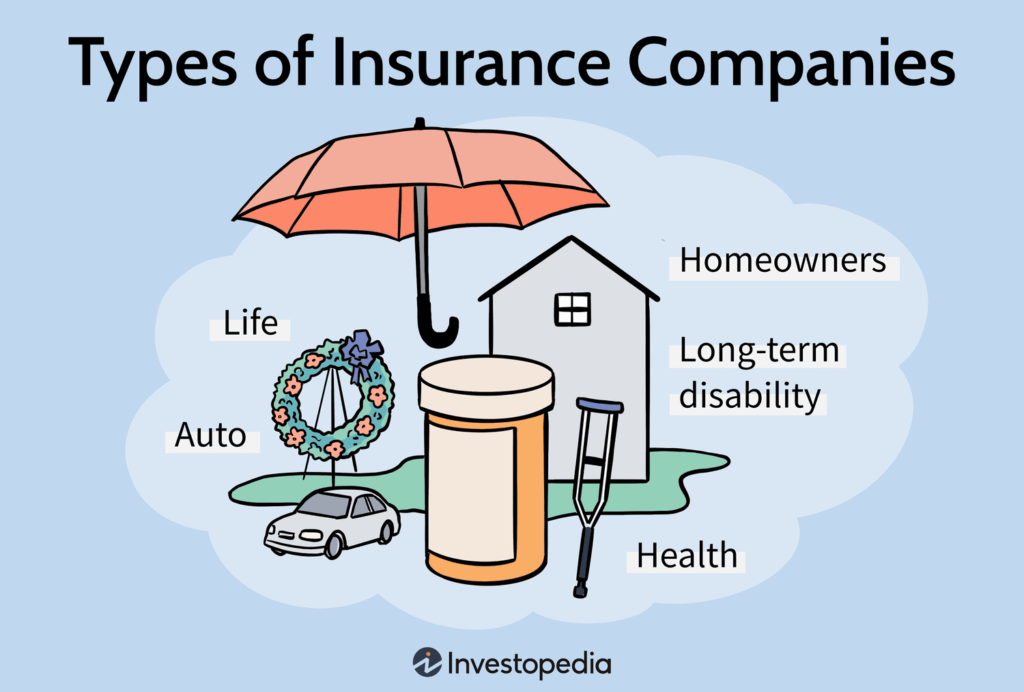

Auto insurance provides coverage for damage or injuries resulting from accidents involving vehicles. It typically includes liability coverage (for damage you cause to others), collision coverage (for damage to your vehicle), and comprehensive coverage (for non-accident-related damage, like theft).

Example: If you’re involved in a car accident, your auto insurance will pay for repairs to your vehicle and cover medical expenses for you or others involved.

3. Homeowners and Renters Insurance

Homeowners insurance protects against damage to a home and its contents due to events like fires, storms, theft, or vandalism. Renters insurance offers similar coverage for individuals renting property, protecting their personal belongings.

Example: A homeowners insurance policy might cover the cost of repairing a roof damaged in a storm, while renters insurance would replace personal items stolen from an apartment.

4. Life Insurance

Life insurance provides financial support to the beneficiaries of the policyholder in the event of the insured’s death. It can help cover funeral costs, outstanding debts, and living expenses for dependents. Life insurance policies come in two primary forms: term life (which covers a specific time period) and whole life (which lasts for the insured’s lifetime and may include a cash value component).

Example: A person with a life insurance policy can ensure their family is financially secure, even in the unfortunate event of their untimely death.

5. Disability Insurance

Disability insurance offers income protection in case the policyholder is unable to work due to a disability or injury. It replaces a portion of the individual’s income, helping them meet financial obligations during recovery.

Example: If a worker becomes injured and is unable to return to their job, disability insurance can provide regular payments to help them stay financially afloat.

6. Travel Insurance

Travel insurance covers unforeseen events during travel, such as trip cancellations, lost luggage, medical emergencies, or flight delays. This type of insurance is particularly useful for international travelers who may face unique risks abroad.

Example: If your flight is canceled or your luggage is lost while traveling, travel insurance can compensate you for additional expenses or losses incurred.

7. Business Insurance

Businesses face a variety of risks, and business insurance provides coverage to protect against liabilities, property damage, or operational disruptions. Types of business insurance include liability insurance, property insurance, and workers’ compensation.

Example: A restaurant might carry business insurance to cover potential property damage or lawsuits from customers who may get injured on the premises.

The Role of Insurers

Insurance companies, also known as insurers or carriers, are responsible for assessing risks, setting premium rates, and paying out claims. Insurers hire underwriters to evaluate the level of risk involved in insuring someone or something, determining how much premium to charge based on this risk.

Additionally, insurers maintain reserves—pools of money set aside to pay future claims. They invest these reserves to ensure they can meet obligations to policyholders.

Understanding Premiums and Deductibles

When purchasing insurance, two key concepts are critical: premiums and deductibles.

- Premium: This is the amount of money you pay regularly (monthly, quarterly, or annually) to keep your insurance policy active.

- Deductible: This is the amount you must pay out-of-pocket before your insurance starts covering expenses. Higher deductibles often lead to lower premiums, and vice versa.

For example, a health insurance policy may have a $500 deductible, meaning you must pay the first $500 of medical expenses yourself before the insurer covers the rest.

Did You Know?

Over 100 years ago, some of the earliest forms of insurance were developed by ancient merchants who would “insure” their goods against losses during sea voyages by sharing the risk with fellow traders. Today, the global insurance industry is worth trillions, touching every aspect of modern life!

Conclusion

Insurance is a crucial tool for managing the financial risks of everyday life. Whether it’s protecting your health, your car, your home, or even your income, insurance offers peace of mind and security against the uncertainties that life brings. By understanding the various types of insurance and how they work, you can make informed decisions to safeguard your future and protect yourself from unforeseen financial burdens. Always carefully review your insurance policies, comparing coverage options and premium rates to ensure that you’re getting the best protection for your needs.